🛡️The Shield Report

Weekly Market Monitor & Risk Analysis

The Bottom Line

The S&P 500 and Nasdaq 100 remain in a Positive Trend.

The Shield Status: 🟢 DOWN (Optimistic / Invested)

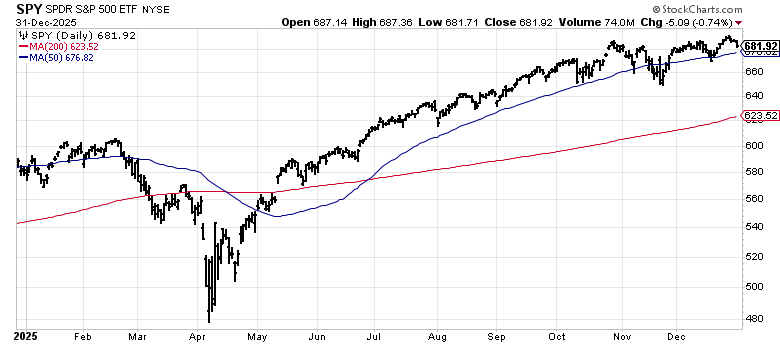

📊 Long-Term Trend Review: S&P 500 SPY 0.00%↑

Status: Positive Long-Term Trend ✅

Key Levels: Price > 50SMA (Blue) > 200SMA (Red

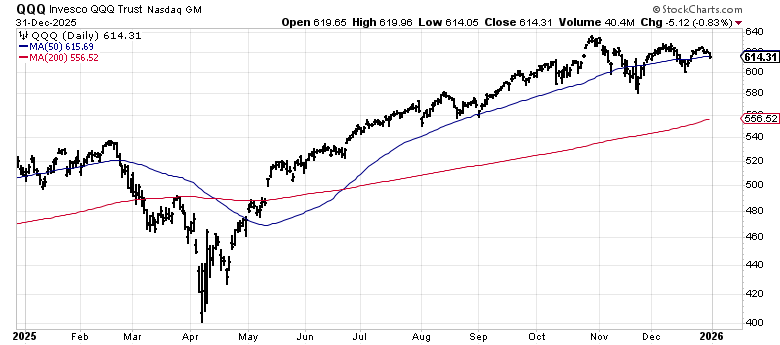

📊 Long-Term Trend Review: Nasdaq 100 QQQ 0.00%↑

Status: Positive Long-Term Trend ✅

Key Levels: 50SMA (Blue) >Price > 200SMA (Red)

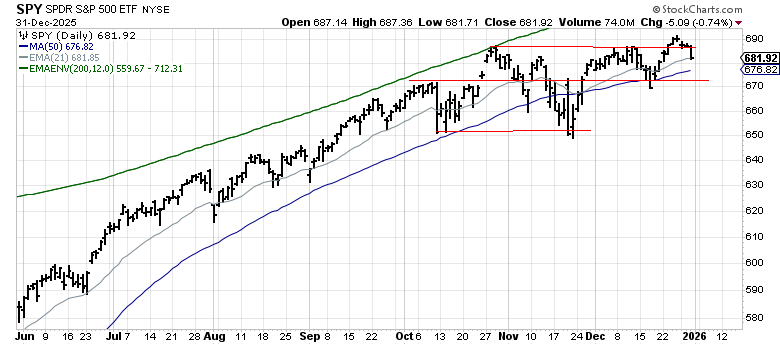

📊 Momentum Trend Review: S&P 500 SPY 0.00%↑

Status: Positive Momentum Trend ✅

Key Levels: 21EMA (Gray) > 500SMA (Blue)

Analysis: After testing resistance in late November, the index pulled back below the 50-day Moving Average (Red Line). We are now seeing a “Higher Low” form—a classic bullish structure. As long as price stays above $672, and the 21EMA above the 50SMA, the trend is healthy.

📊 Momentum Trend Review: Nasdaq 100 QQQ 0.00%↑

Status: Positive Momentum Trend ✅

Key Levels: 21EMA (Gray) > 500SMA (Blue)

Analysis: Tech showed weakness in November but found support near the October lows ($590). Momentum has reset. We are watching for the rally to continue above the $625 resistance line to confirm the next leg higher.

🧠 Sentiment & Themes

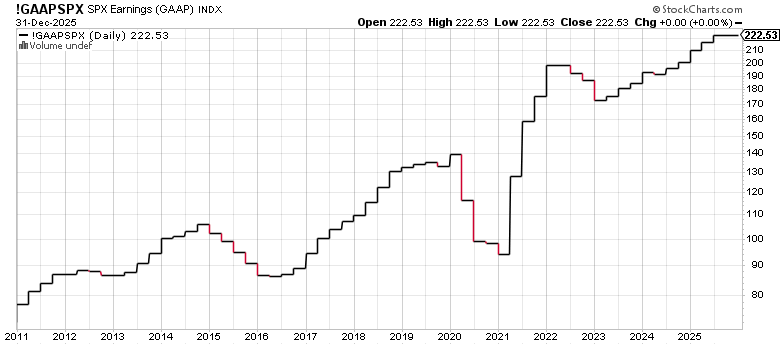

The Fundamental Floor: Earnings Growth

While we trade on price, we respect the fundamentals. S&P 500 earnings have remained resilient and growing throughout the year, defying recession predictions.

Verdict: Constructive. stock prices tend to follow corporate profits. The fact that earnings are expanding validates this rally—it suggests this is not just a speculative bubble, but an uptrend supported by real cash flow.

Sector Spotlight: Semiconductors (SMH)

Semiconductors are currently a “mixed bag,” but the internal rotation is bullish.

The Divergence: While mega-cap giants like Broadcom AVGO 0.00%↑ and Nvidia NVDA 0.00%↑ are still attempting to rally off support, new leadership has emerged in names like Micron MU 0.00%↑ and Lam Research LRCX 0.00%↑ , which are coming off of new highs.

Technical View: The recent pullback in the Semiconductor ETF SMH 0.00%↑ appears to have been a temporary lull rather than a trend change. The group is cycling higher again, and we are watching for the trend to continue into a decisive breakout above $370 resistance to confirm the next leg up.

The M5 Power Rankings December 2025

T5. J.P. Morgan

T5. LOCKED

4. LOCKED

3. LOCKED

2. LOCKED

1. LOCKED

Want the rest of the list?

You’ve seen the Momentum Signal and our Bonus Pick (JPM). But the M5 Strategy flagged 5 other high-momentum setups heading into January that are moving right now.

Unlock the full M5 Power Rankings instantly and get:

✅ The Top 2 Healthcare Breakouts (Rotational plays).

✅ The Top 3 Mega-Cap Tech Leaders (Trend continuation).

✅ Weekly Updates & Trends for every ticker.

See the full list free for 7 days.

Disclosures

Momentum Wealth Planning, LLC (“Momentum”) is a federally registered investment adviser under the Investment Advisers Act of 1940. Registration as an investment adviser does not constitute an endorsement of Momentum by the SEC nor does it indicate that Momentum has attained a particular level of skill or ability.

The information herein was obtained from various sources. The information provided is believed to be from reliable sources but no liability is accepted for any inaccuracies or completeness of information provided by third parties. The information in this communication is given as of the date indicated and believed to be reliable. Momentum assumes no obligation to update this information, or to advise on further developments relating to it. This is for information purposes and should not be construed as an investment recommendation. Past performance is no guarantee of future performance.

The material presented by Momentum Wealth Planning, LLC is for informational purposes only. It is not intended to serve as a substitute for personalized investment advice or as a recommendation or solicitation of any particular security, strategy or investment product. Actual economic or market events may turn out differently than as presented. Materials posted to this site are from external sources and are provided for your convenience in locating related information and services. Momentum expressly disclaims any responsibility for and does not maintain, control, recommend, or endorse third-party sites, organizations, products, or services, and make no representation as to the completeness, suitability, or quality thereof.