Philosophy

Our Philosophy: Beyond ‘Buy-and-Hold’

Most investors aren’t “Passive”—they are vulnerable. Passive index investing is a strategy that offers no plan for navigating serious market drawdowns or managing the risk of individual stock failure.

We provide the Shield & Sword System to replace “Passive Investing” with a repeatable, systematic research process.

1. 🛡️The Shield: Killing “Passive Investing”

The biggest lie in finance is that you must passively sit through 50% drawdowns to be a successful investor. During the Dot.Com crash and the 2008 Financial Crisis, the broad market lost half its value—often taking over a decade just to break even.

The Problem: “Buy and Hold” becomes “Buy and Hope” the moment the market turns Red.

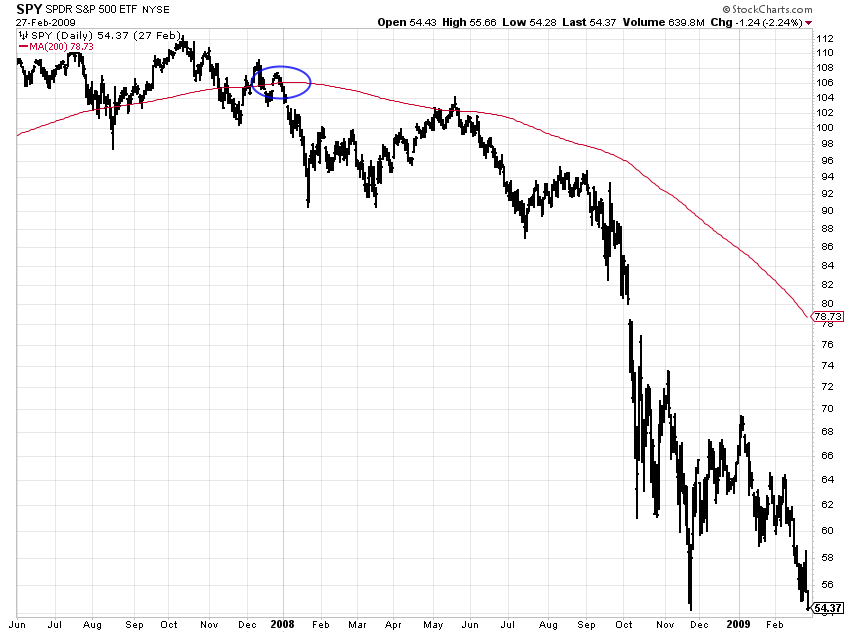

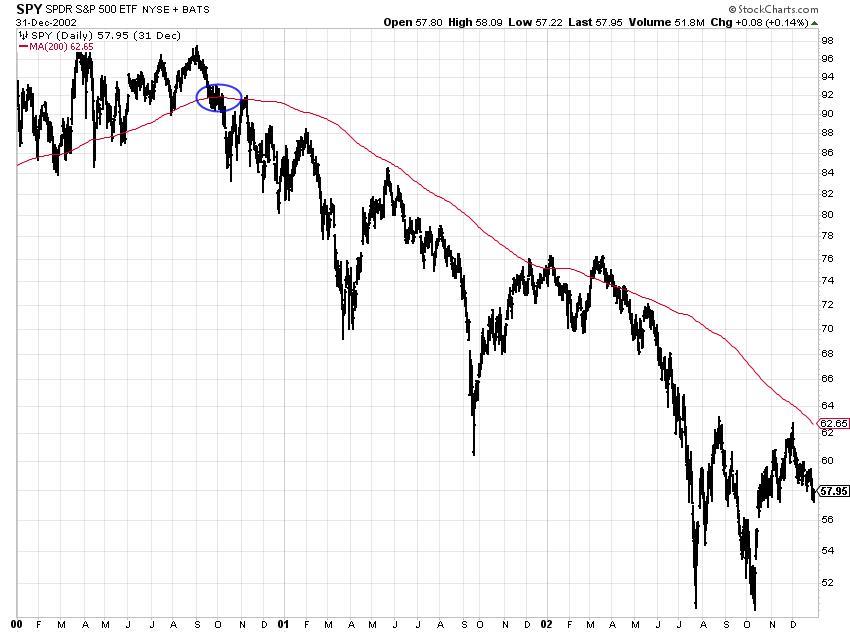

The System: We monitor the “Red Line” (200-day Moving Average). When the index falls below this trend, the Shield turns RED. We don’t “pray”—we exit to preserve capital and wait for the trend to turn back in our favor.

Take a look at the Dot.com Bubble and the Financial Crisis in relation to ‘The Red Line’ and how using this as a risk management signal is key.

This is further confirmed in depth by Meb Faber. Read his case study here: https://mebfaber.com/wp-content/uploads/2016/05/SSRN-id962461.pdf

The Dot Com Crash (2000-2003)

The Financial Crisis (2008-2009)

2. ⚔️The Sword: Capturing Momentum

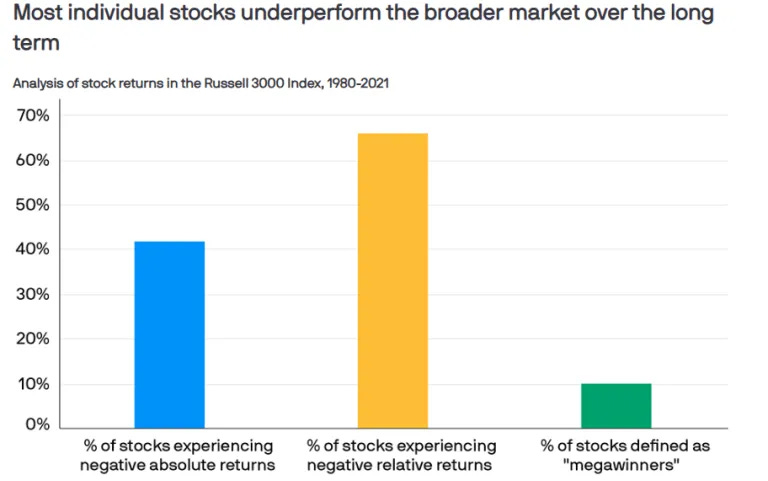

A landmark study by J.P. Morgan Asset Management showed the following:

The 66% Drag: Two-thirds (66%) of all stocks in the Russell 3000 between 1980 and 2021 actually delivered negative relative returns compared to the index.

The Absolute Failure: Over 40% of individual stocks experienced negative absolute returns over that same period—meaning they simply lost money.

The 10% Solution: All net wealth creation in the market is driven by a tiny minority (~10%) of “megawinners.”

The Sword is designed to filter out the “haystack” and isolate the “needles.”

Relative Strength Isolation: We don’t care about “cheap” stocks; we care about leaders. We use momentum in attempt to identify these top 10% of stocks that are actually driving the market’s gains.

Monthly Rotation: If a “megawinner” begins to lose its edge and slips into the 66% of underperformers, we rotate. The Sword attempts to position where the momentum is flowing, not where it’s being destroyed.